Table of Contents

- Maximum 401(k) Contribution for 2025 | Finance Strategists

- 2016 IRA, 401K And Roth IRA Contribution Limits | Roth ira ...

- Higher 401(k) contribution limits mean little to many workers

- Accounting for Employee after-tax 401k contribution (This is NOT ...

- 401k - The 3 Roles of a 401k Plan

- How Much Contribute … - Adelle Crystal

- 401(K) contribution limits are set to rise in 2024 - here's how to plan ...

- Catch-Up Contributions Into a Roth 401(k) Isn't a Bad Idea | Kiplinger

- Personal Finance

- 401K Contribution Limits 2024 All You Need To Know About, 50% OFF

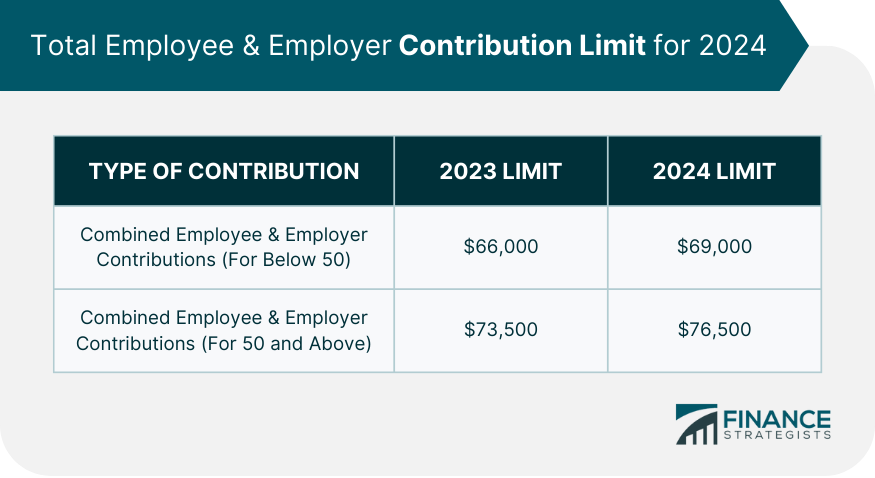

Changes to Catch-Up Contributions

Expansion of Automatic Enrollment

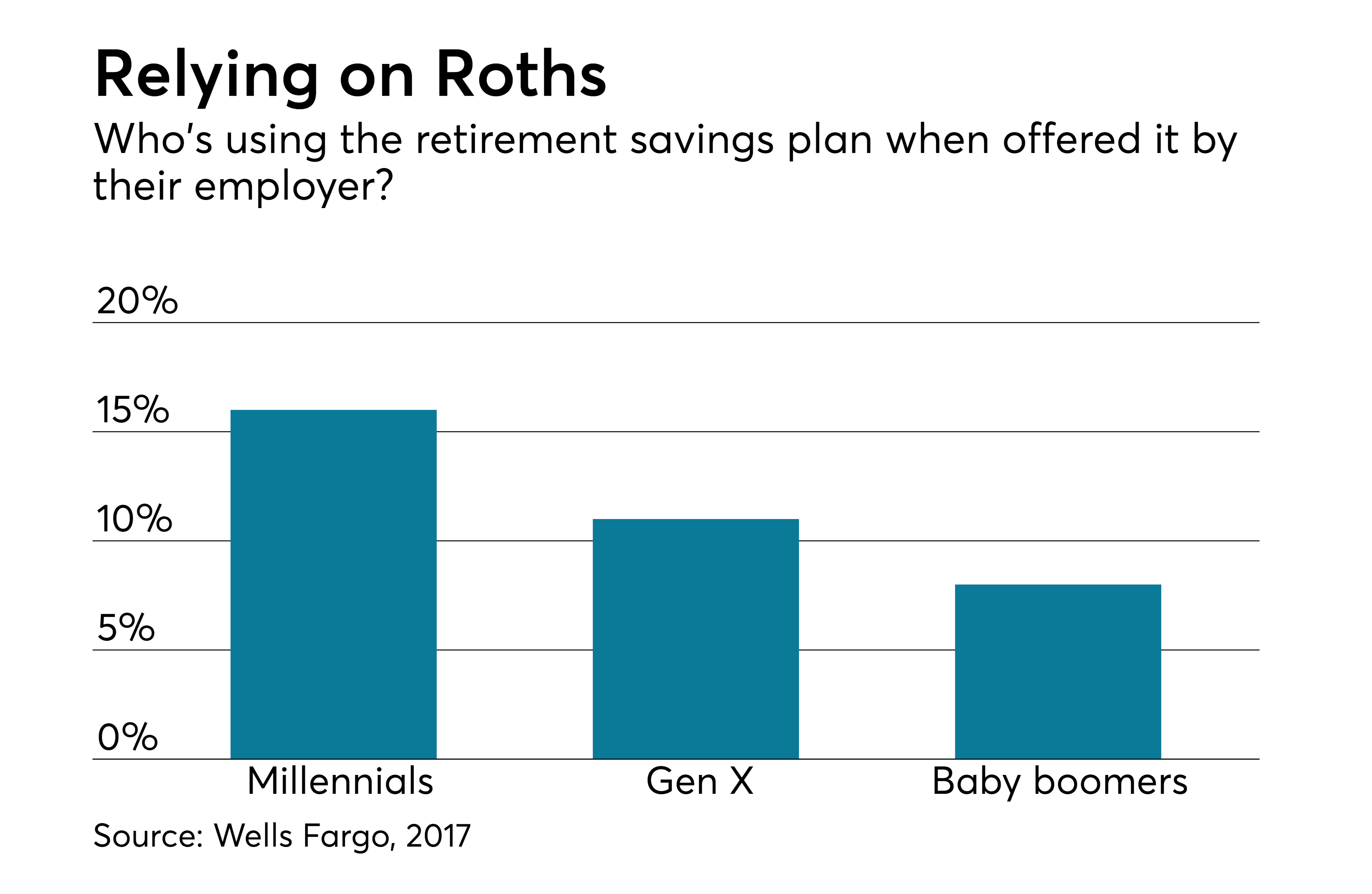

Roth 401(k) and Roth IRA Changes

The upcoming years will also bring about changes to Roth 401(k) and Roth IRA plans. Starting in 2025, employers will be required to offer Roth 401(k) plans as an option, allowing employees to contribute after-tax dollars to their retirement accounts. Additionally, the income limits for Roth IRA contributions will increase, making it possible for more individuals to take advantage of these tax-advantaged accounts.

Student Loan Repayment and Retirement Savings

In a bid to help employees balance student loan repayment with retirement savings, the 2025 changes will introduce a new feature. Employers will be able to offer matching contributions to employees' retirement accounts based on their student loan payments. This innovative approach will enable employees to prioritize both their retirement savings and debt repayment, without having to sacrifice one for the other.

Increased Transparency and Disclosure

Lastly, the upcoming changes will prioritize transparency and disclosure in retirement plans. As of 2026, plan administrators will be required to provide more detailed information about fees, expenses, and investment options. This increased transparency will empower employees to make informed decisions about their retirement savings and investments. In conclusion, the major retirement plan changes set to become effective in 2025 and 2026 will have a profound impact on the way Americans save for their golden years. From increased catch-up contributions to expanded automatic enrollment and improved transparency, these changes will provide a much-needed boost to retirement savings and security. As the retirement landscape continues to evolve, it is essential to stay informed and adapt to the changing landscape to ensure a comfortable and secure retirement.By staying ahead of the curve and understanding the upcoming changes, you can take proactive steps to optimize your retirement savings and make the most of these new opportunities. Whether you are an employer or an employee, it is crucial to be aware of these changes and how they will affect your retirement plans. Stay tuned for more updates and insights on the evolving retirement landscape.